Gift Amounts For 2025 - 2025 Max Gift Amount Susan Estrella, (the figures adjust annually on january. Annual Gifting For 2025 Image to u, The internal revenue service (irs) has released its tax inflation adjustment figures for tax year 2025.

2025 Max Gift Amount Susan Estrella, (the figures adjust annually on january.

Gift Amount For 2025 blair coralie, In 2025, the annual gift exclusion will rise to $19,000 per recipient—an increase from the $18,000 limit in 2025.

Annual Gift Tax Exclusion 2025 Arden Sorcha, For those that already have a gifting strategy or plan significant gifts in 2025—such as contributing to tuition or a down.

What Is The Gift Amount For 2025 Anna Delilah, Taxpayers typically only pay gift tax on the amounts that exceed the allotted lifetime exclusion, which is $13.61 million in 2025 and $13.99 million in 2025.

2025 Max Gift Amount Susan Estrella, This means you can gift up to $19,000 to each person in your.

Allowable Gift Amount 2025 Catina Jaynell, Effective january 1, 2025, you will be.

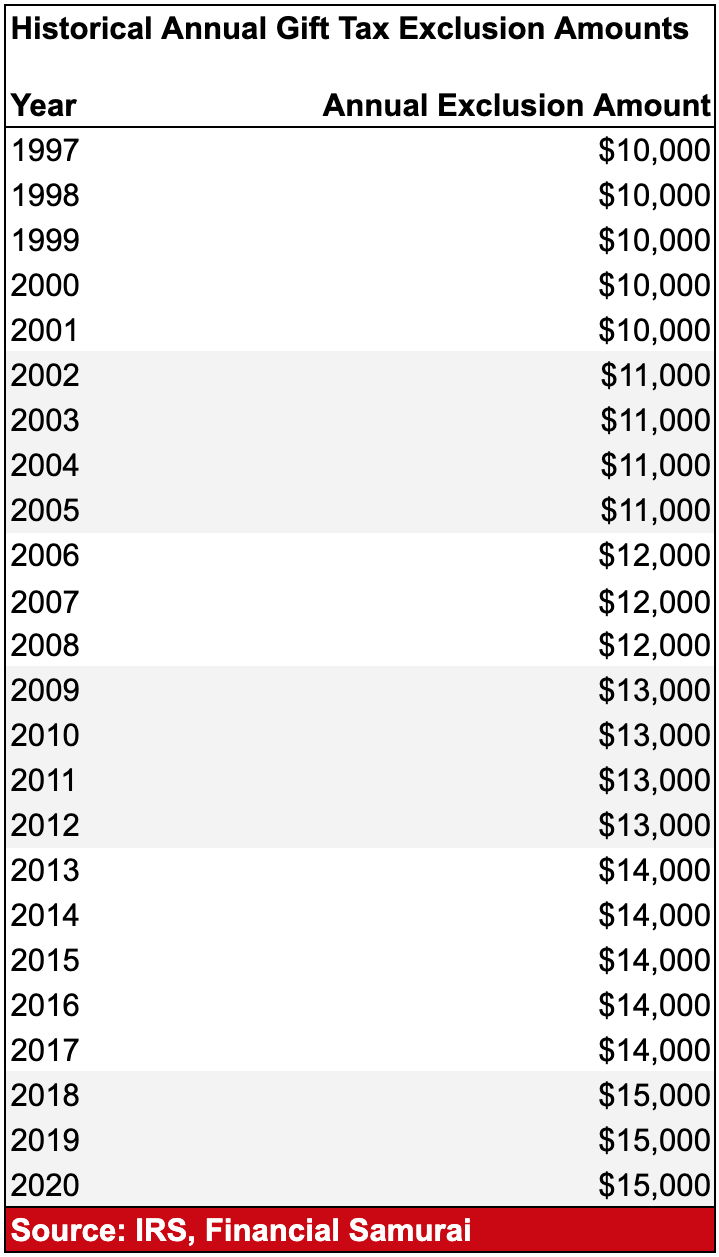

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, The lifetime federal estate and gift tax exemption has increased to $13,990,000 per person (or $27,980,000 per married couple) for.

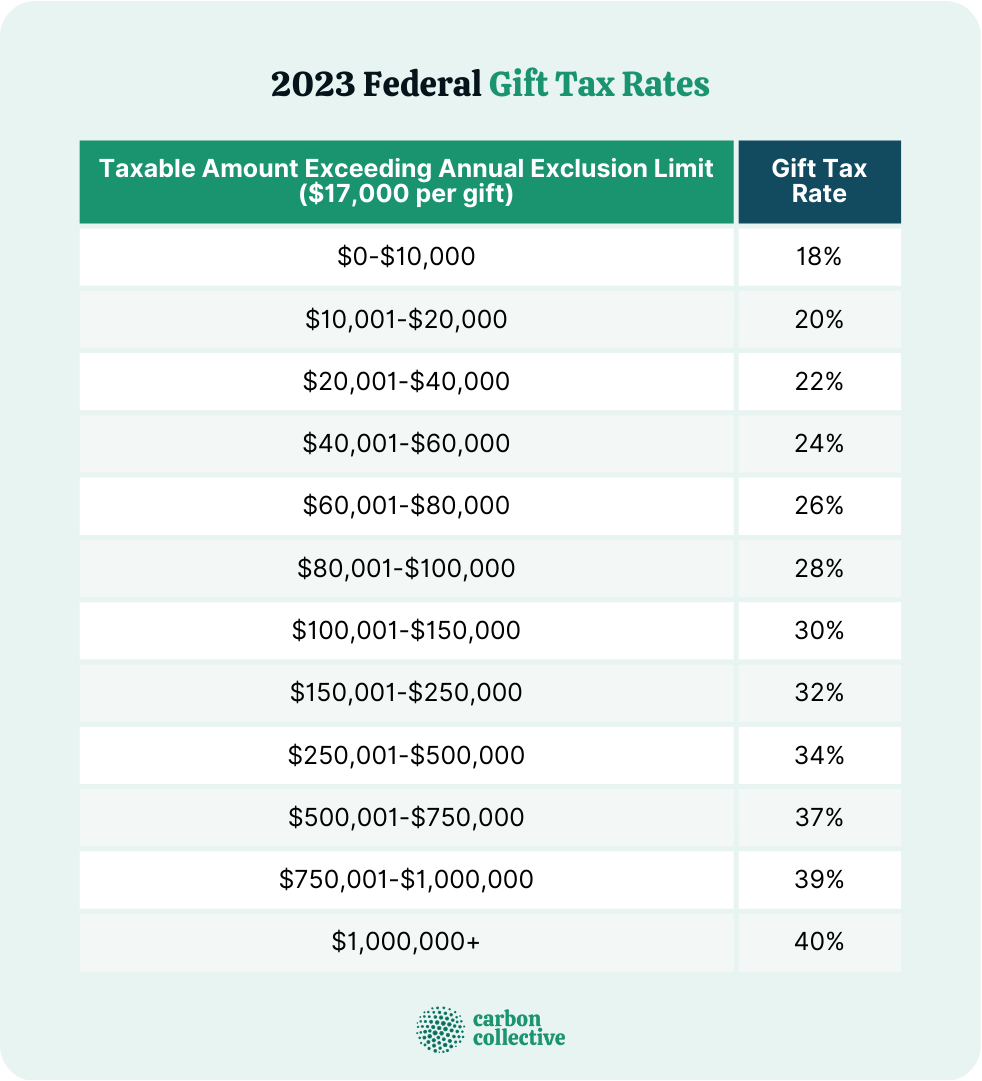

Taxpayers typically only pay gift tax on the amounts that exceed the allotted lifetime exclusion, which is $13.61 million in 2025 and $13.99 million in 2025. You only pay the gift tax if you exceed the lifetime exclusion, and that only happens if you exceed the annual exclusion.

Understanding The Gift Tax Exemption A Comprehensive Guide To The 2025, Estate and gift tax exemption:

Gift Amounts For 2025. For those that already have a gifting strategy or plan significant gifts in 2025—such as contributing to tuition or a down. You only pay the gift tax if you exceed the lifetime exclusion, and that only happens if you exceed the annual exclusion.

How Much to Give for Graduation Gifts Greatest Gift, Lifetime estate and gift tax exemption.